5 Insurance Agency Marketing Secrets To Massive Growth In 2020

Photo by Merakist

Originally Posted On: https://www.growthgenmedia.com/5-insurance-agency-marketing-secrets-for-2020

Looking To Grow Your Insurance Business In 2020? Implement These 5 Simple Yet Powerful Marketing Secrets Before Doing ANYTHING Else!

The insurance agency marketing industry is in your face everywhere you turn. Geckos, emus, sports athletes, celebrities…lay your eyes on any media, and it seems like insurance companies are using it for marketing.

If you are in the insurance sector as a business or as an agent, you know how stiff the competition is because of this fact.

It seems like every 30 seconds there’s a new commercial, banner ad, group sponsorship or radio commercial with insurance agencies and agents trying to get clients by pushing hard on marketing and selling.

How do you stand out in the crowded marketplace that is insurance sales? Getting new insurance clients in 2020 is different than in the past. Much different.

Insurance marketing takes many forms. It’s not just commercials and ads. Many agents don’t even consider some of what you’re about to read, but the big agencies do.

There are many marketing approaches to getting clients even if you don’t like the act of “selling” or don’t have the budget of the big industry players.

Leads online or offline are expensive and agents need to optimize EVERY SINGLE LEAD in order to be able to compete. Most often, it’s not about getting more leads, but rather having the right process in place for the leads you get, which is where 90% of agents fall short.

Leads can turn into sales if you know how to put the right system in place.

Here are the top 5 insurance agency marketing secrets for 2020 to convert your leads into fruitful sales that successful agents use and struggling agents don’t.

1) Have a robust organization system to keep track of everything.

Superior Customer Relationship Management (CRM) software is one of the most useful organizational systems you can integrate into your lead generation and conversion process.

This tool combines the technologies, strategies, and practices that you need to utilize as a business or as an insurance agent so you can successfully analyze and control customer interactions and flow.

Customer life cycles can be a part of this system. If you know how to use it, you can improve your relationships with your customers, increasing retention, and propelling ongoing sales growth.

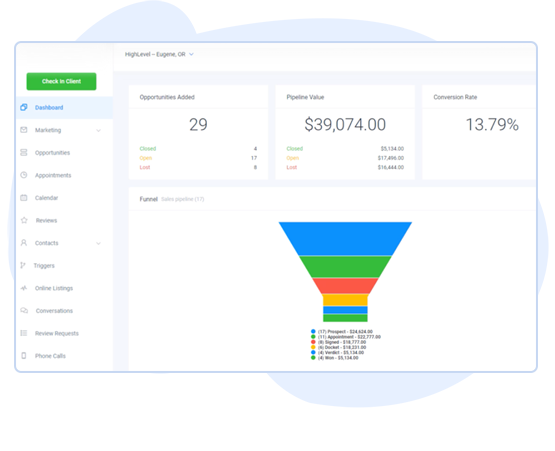

This may sound very advanced to many, especially if you are just an individual trying to gain clients by all means possible. The good news is that in 2020 it’s never been easier to use a great CRM system. (Growth Engine’s CRM system dashboard shows potential active and closed business)

(Growth Engine’s CRM system dashboard shows potential active and closed business)

So think of it as an investment rather than an expense. Having a robust system to help you track your leads and customers will help you find out the most important details about them that help the client-agent relationship in the long-term.

A great CRM in 2020 can also do way more than just keep track of your business. It’s also useful for marketing, communication, reputation management and more should you choose to take advantage of these extras.

2) Have a VERY SIMPLE way for prospects to reach out to you WITHOUT talking on the phone.

Potential customers can be easily annoyed when you open the discussion about insurance with them. Can’t blame them, there are many insurance agents who are too pushy to make sales who have caused this.

What most prospects don’t like is the idea of you calling them on the phone. Some customers find it too time-consuming, while there are those people who are just simply not fond of talking over the phone for ANY reason.

These are just some of the challenges you will have to face when you are trying to gain new clients and write new policies.

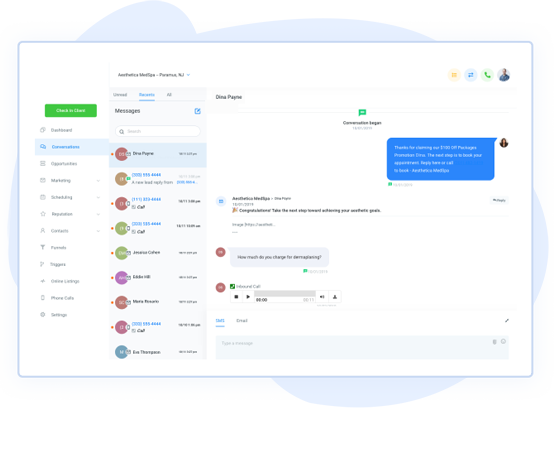

Since technology is continuously evolving, there are better ways for your clients to reach out to you that reduce the customer pain of a long phone conversation.  (Growth Engine’s communication dashboard puts email, text and messenger conversations all in one spot for ease of use)

(Growth Engine’s communication dashboard puts email, text and messenger conversations all in one spot for ease of use)

Give up the idea of phone calls until there is some level of trust. There are better options now.

One great alternative is to start with an online quote. If you have a solid funnel (aka website), integrate a button so your prospects can easily request an online quote from you. You will find this approach more flexible than phone calls.

The key here is what happens after they click the button? You have to ask SPECIFIC questions about their intent. We’ll touch on that here in a second…

3) Make them feel they will get FAST results if they reach out.

Being an attentive insurance agent makes a difference. The competition is spending record amounts on marketing and you can’t afford to waste a second not giving answers to your prospects, especially when they don’t know you and have no allegiance to you.

As much as it’s harder on businesses, people want answers now! Great agents know this and give people answers quickly.(Example of “quick” results offering online quotes 24/7)

There is no need for phone calls or a face-to-face meet up until a bit further down the buyer journey…after the prospect starts to trust that you are responsive.

You can make them feel taken care of by answering their inquiries immediately with complete details of what they are looking for.

If you give them what they asked for during your initial discussion, they will know that they are transacting with a smart and attentive agent. They will feel that you can give them results even if they are just inquiring about your products.

Another way you can make them feel that they will get fast results when they reach out is by generously giving them all the ways they can contact you; your email, cell phone number, messenger link, calendar link, social media accounts and other similar communication portals.

This is proof that you will be ready to assist them any time once they reach out.

4) Communicate with them on THEIR preferred platform, not yours.

This goes hand in hand with #3 above.

There are some insurance agents who simply don’t understand this.

If you like to use old fashioned email exclusively, no offense…but you must just hate money!

Prospects preferred communication platforms have changed and so should yours.

You have to adapt…this is another secret successful agents don’t often talk about.

Many times it is a fear of additional technology or fear of messing up with a platform agents are not familiar with that’s the underlying issue.If you want to stand out in this industry and expand your book of business, you simply can’t let that happen.

Communication is the FOUNDATION of getting a new client and keeping that client for years.

Generating leads in this competitive environment is challenging and you can make it worse by deciding on a single channel where your prospects MUST communicate with you.

The privilege to choose a communication platform is not yours, it should be with your leads and clients.

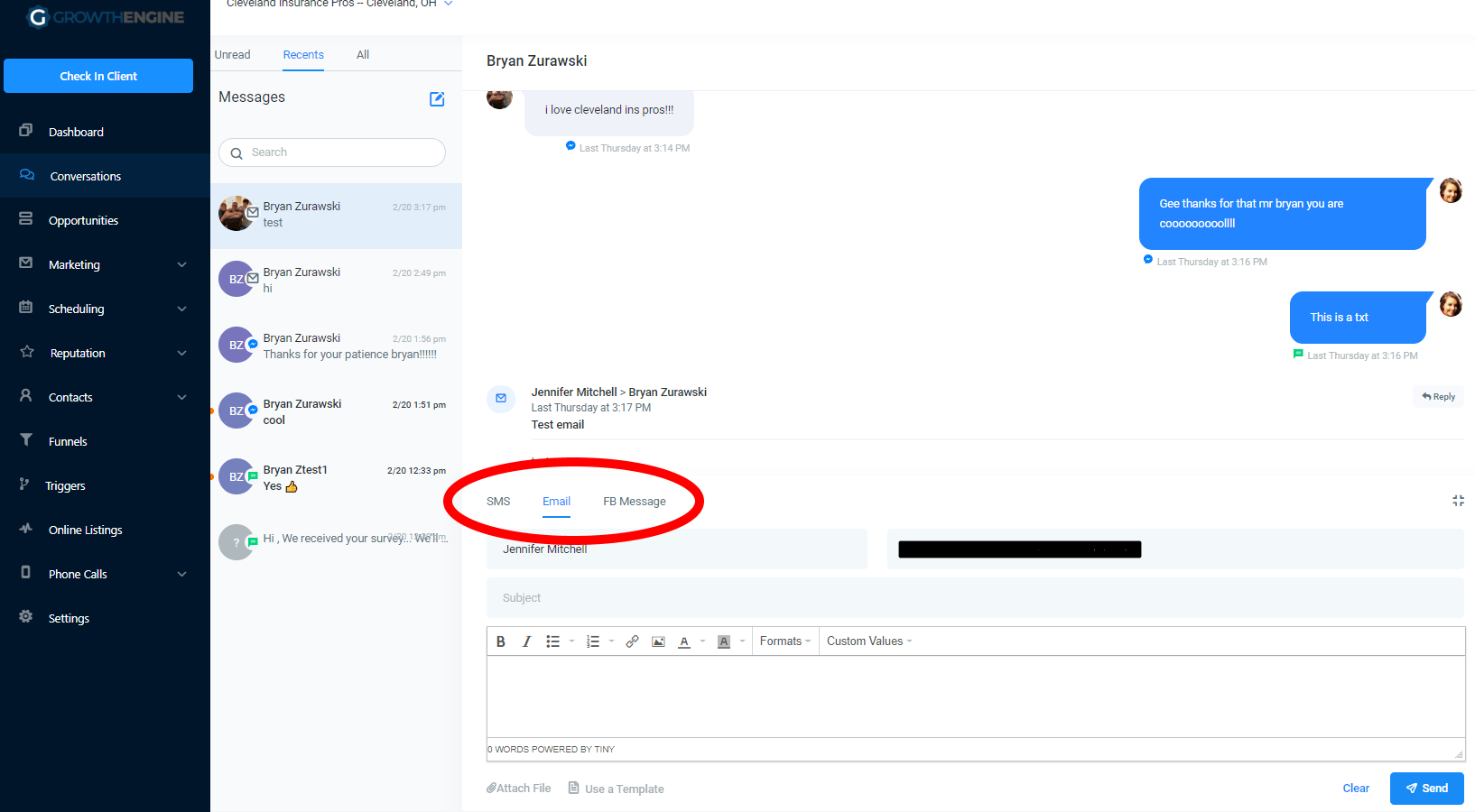

If they want to communicate through Facebook Messenger or text, don’t lead them to your email or office phone number.  (Growth Engine 2-way communication dashboard showing phone, email, text and Facebook messenger all in one dashboard)

(Growth Engine 2-way communication dashboard showing phone, email, text and Facebook messenger all in one dashboard)

If they tell you they like email, don’t tell them to reach you out on Facebook and vice versa.

You should communicate with your online leads on their desired platform. “But Bryan, when a lead comes in, I won’t know their preference!” No worries, just give them options upfront and respond quickly to any way they choose. In fact… automate it so a robot responds on your behalf!

This way, you are making them feel valued because of your attentiveness to reply, no matter how they reach out to you.

5) Automate the process using intelligent robots from beginning to end for continued engagement with your prospect.

Automation will save you a lot of time, effort and money. In fact, it will actually MAKE you money. It will also make you look like an absolute superstar agent!

This is the greatest of all hacks because you don’t have to recreate a process over and over again every time you have new leads or hear yourself say “DANG IT, I MISSED THAT LEAD!”

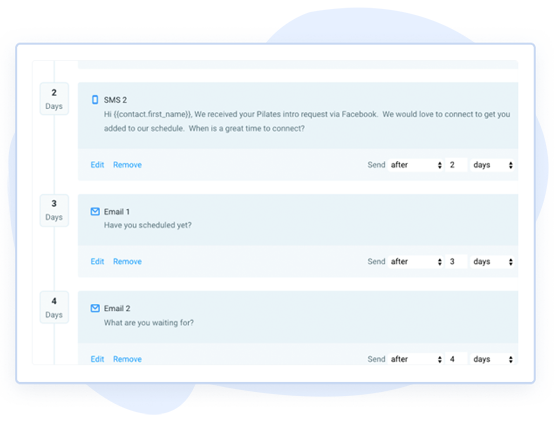

Intelligent robots can do the work for you from start to end. You just have to program them to execute your desired process initially.  (Growth Engine’s marketing campaigns let users intelligently automate the type and frequency of outbound messaging including phone calls, emails, texts, FB messenger, voicedrops and more)

(Growth Engine’s marketing campaigns let users intelligently automate the type and frequency of outbound messaging including phone calls, emails, texts, FB messenger, voicedrops and more)

Once your automation has successfully been tested prior to launch, you’ll know you have a winner that you can use in perpetuity.

Just imagine artificial intelligence working and making money for you no matter what time of day or night it is!

While your robots do the work, you can use your time saved for other productive activities…like keeping up with actually writing new policies!

With AI at your service, you will also have more free time for yourself and everyone will still think you’re working non-stop. Don’t worry…WE WON’T TELL A SOLE!!

Need Help Automating Your Leads And Conversions?

Check out the case-study demo video below and see exactly how an insurance agent is converting leads on autopilot…while she’s sleeping!Watch The Case Study Video