Originally posted on https://masscommercialproperties.com/the-4-most-common-reasons-people-sell-commercial-property-too-late/

If you waited to sell commercial property during the last market correction between 2008-2010, it would have cost you an average of 30.3% of your property value.

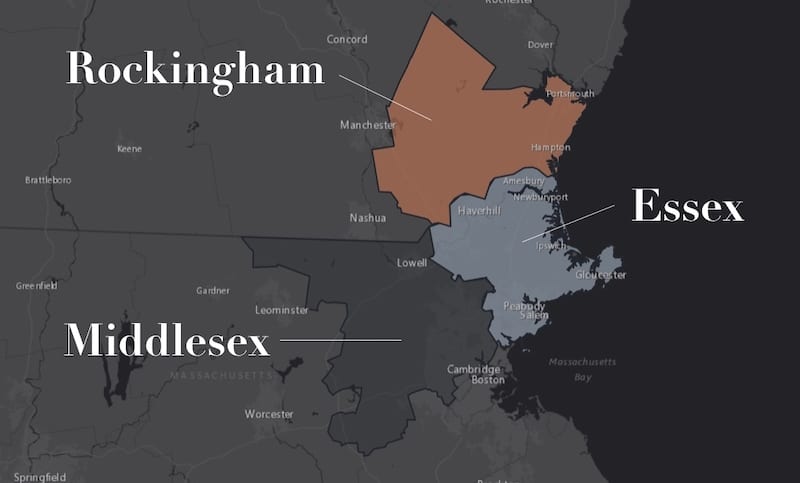

In Essex, Middlesex, and Rockingham Counties, people who chose to sell commercial property at the bottom of the market suffered losses.

Office values between 2008-2010 fell 48.9%.

The average decline in flex property values was 23%, retail properties declined by 26.2%, and industrial properties declined by 10.5%.

According to Dr. Chris E. Lee, market cycles over the past 45 years lasted on average 10 years.

He identified that real estate transition years that resulted in growth phases have started the 3rd year of each decade and ended by the 8th year of that decade.

Transitions to growth phases occurred in 1973, 1983, 1993, 2003, and 2013.

Market declines have followed transitions on the 8’s over the past 45 years.

This means that market declines have followed 1978, 1988, 1998, and 2008.

If market cycles reoccur, then why do people sell commercial property in a decline?

Reason #1

Why people sell commercial property too late:

Complacency

Complacency is the most dangerous state to ignore.

It’s the moment before the market corrects and values decline. When the market goes through this initial correction, our natural tendency is to be complacent because initial corrections actually look like a cool off period.

Then we expect the market to pick up again and continue with its growth phase.

139 sellers realized -30.3% losses in the 2008-2010 market decline.

But, the market continues to deteriorate and worries creeps in as we wonder what is going on. Next, it is normal to say to yourself that your investments are good ones that they’ll ultimately come back.

When the market continues to soften until it seems there is no hope in coming back, that’s the absolute bottom of the market and the worst time to sell.

This point of capitulation is one of surrender and of asking how the government could let something like this happen.

Reason #2

Why people sell commercial property too late:

Ownership and Identity

In order to avoid loss, people will overvalue what they own.

That is what Richard Taylor, Daniel Kahneman and Jack L. Knetsch identified with the Endowment Effect. In fact, Kahneman and Knetsch won the Nobel Peace Prize for their research in this area of behavioral economics.

It’s normal for people to overvalue what they own.

In a study with Cornell undergrads, broken into groups and given identical coffee cups, Kahneman and Knetsch told one group to value the cups they owned and the other group to value the cups they would purchase.

They found the undergrads with the coffee cups were unwilling to sell their coffee cups for less than $5.25 while their less fortunate peers were unwilling to pay more than $2.25 to $2.75.

But, it was Carey Morewedge’s research into the Endowment Effect that revealed that it’s not loss aversion that leads to overvaluation, it’s ownership and identity.

Morewedge found that it’s our sense of possession creates the feeling of an object being mine, which then becomes a part of our identity.

The coffee cup overvaluation means that deciding to sell commercial property means letting go of a piece of identity — it’s hard to do.

Reason #3

Why people sell commercial property too late:

Loss Aversion

Why is it so difficult to sell commercial property in a market decline?

According to Brafman and Brafman, authors of Sway: The Irresistible Pull of Irrational Behavior people will go to great lengths to avoid perceived losses.

What’s more, people also succumb to their will to recover what once was. They will spend whatever it takes not to lose, be it time, money, or emotional resources.

Imagine watching someone playing craps in Las Vegas. When they are on a roll, taking in their winnings, they race through the growth phase, reaching the peak of the game.

They feel ecstatic.

But what happens when the tide turns and they start to lose?

They enter the complacency stage, call it a short turn of bad luck, and keep playing. They believe they will return to the top. But their bad luck continues.

By waiting to avoid losses, people hold off and then sell at the wrong time — maximizing their losses.

They lose their winnings, keep playing and generate losses. They would rather hold onto the idea of getting back to where they were at almost any cost, than realizing their loss and moving on to another opportunity.

Reason #4

Why people sell commercial property too late:

Self Reliance Time Traps

Time Trap #1: Self-Education

People will self educate online because it is free and immediately available. A review of the search term on Google for “commercial real estate trends” returned 152 million results. A search for “commercial real estate trends YouTube” turned up 310 million results!

No doubt, an abundance of free information in the form of market data, blogs, market reports, and online opinions on what’s happening in the market is available.

Time Trap #2: Friends, Family, and Non-Commercial Advisors

When we aren’t sure what to do, we often consult friends, family, and non-commercial real estate advisors for input. Unfortunately, these people will not want to be the ones to say sell because it is easier to say no and risk being wrong than to say yes and risk not being right.

Plus, most of these folks will not have the data that you have seen here. These people are more likely to share anecdote based advice like “My friend made a killing in real estate. You should hold on, it will come back.” Remember, people who made this mistake lost in 2008-2010.

Time Trap #3: Post to Loopnet and Wait for a Buyer

A search on Loopnet shows how easy it is to post a property for sale.

That is one of the reasons why Loopnet boasts being a marketplace where you can sell commercial property and be one of 500,000 listings that are available worth nearly $240B. The truth is, Loopnet’s reputation among commercial real estate brokers is of being a poor quality lead source.

And, while it may be a large commercial real estate marketplace, buyer interest there wanes in a down market.

A recent review of Google search trends showed that from 2004 to 2010 the search term “Loopnet” revealed search activity that mirrors the real estate market cycle.

That means that when listing a property on Loopnet for sale in a declining market, buyer interest in searching for property on Loopnet is also declining. The result is that it takes longer to sell property as values are in decline and losses are building.

Time Trap #4: Hire a Traditional Broker

It is easy to find a traditional broker, given that 1 in 164 people in the United States today have a real estate license. According to the National Association of Realtors there are about 2 million active real estate licensees in United States.

The problem is that most traditional brokers will rely on the rule of the 3Ps.

Put the property on the market on Loopnet. Post a for sale sign in front. Pray that someone will buy it.

What’s more, in the 2017 National Association of Realtors Commercial Member Profile, experience is not lacking, production is.

- 59% of traditional brokers have been in business for 26 years or more with an average age of 60 years old.

- 12% focus on investment sales.

- 74% belong to Loopnet.

- The median annual transaction volume is only $4 million, which in the Greater Boston commercial real estate market is equal to 1.5 transactions.

Ultimately, very few resources have the expertise to ensure the successful sale to the right buyer at the right time.

MANSARD was named one of the largest commercial real estate selling brokers in Massachusetts in 2018 by the Boston Business Journal.

88.9% of MANSARD’s recent deals closed on time and at our client’s accepted offer price.

That’s because at MANSARD, we deliver engaged buyers who close, guarantee experience and knowledge, and outrank our competitors by average sale transactions per broker.

Case Studies

40,000 SF Office Building Sold for $5,500,000

Situation – Acquired as a 3 year reposition, this 41,000 SF office building located at 41-55 North Road in Bedford, Massachusetts underwent nearly $2M in capital upgrades and was leased to 80% occupancy. The time had come to return capital to the investors.

Process – We undertook a public marketing process with a priced offering at $5.5M and a bid deadline. We generated 5 offers that topped out at 90% of the asking price until we began the negotiations.

Result – The property sold for 100% of its asking price within 60 days of going under contract.

Coldwell Banker Retail Property: Sold

Situation – A 40 year investment partnership sought to sell, requiring top value and assurance of close. During the marketing period, Coldwell Banker vacated, followed by a title issue that prevented a sale.

Process – We conducted a national search, registering 49 buyers. 8 cash bids were received and negotiations resulted in a winning offer, 60 day cash close. We coordinated an attorney to clear the title, working with the buyer’s title company and legal team for 3 months.

Result – Property is under contract with a clear path to close.

Privately Marketed: Sold for $3,900,000

Situation – Family office requested a discrete, private sale of the 100% net leased near term medical office and retail property located at 1069 Broadway in Saugus, Massachusetts.

Process – We conducted confidential outreach to our database of qualified buyers combined with owner profiling calls to area investors inclined to acquire this property type, resulting in 12 buyer-seller meetings at our office. In the interviews, the sellers gained insight into market demand for the property and focused on the right buyer.

Result – 4 offers were generated and the property was ultimately sold for $3,900,000.