How To Provide Proof Of Income

Proof of income is a significant number not only for you but also for a variety of people you’ll have dealings with, from landlords to lenders and health insurance exchanges.

But depending on the type of work you do, how to provide proof of income can get tricky. Fortunately, we’ve done our research and are ready to demystify this all-important topic for you.

Keep reading for the lowdown on what counts as proof of income.

Proof Of Income: W-2s And Beyond

If you’re a full or part-time employee, you’ll get a Form W-2. This form should be provided to you by your employer approximately one month after the end of the tax season, December 31st. Hence, this date usually falls on January 31st.

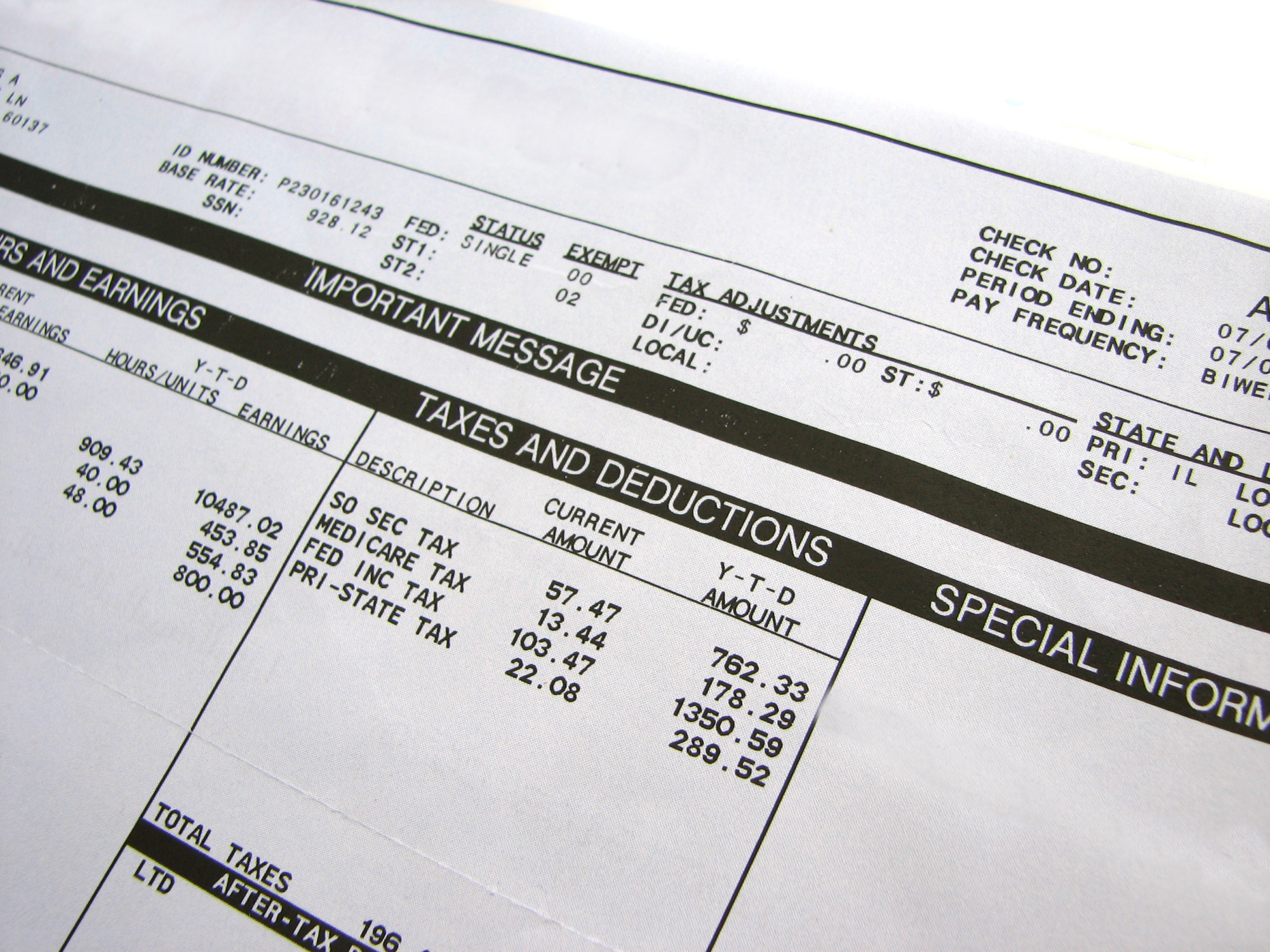

But a W-2 alone won’t serve as enough proof of income. You’ll also need to bring in a recent pay stub (within the last 30 days), which shows what you earn in terms of an hourly wage or salary.

You may also be able to use a W-2 with a recent paycheck image or bank statement. But what if you have a unique circumstance? For example, you might earn a bonus or commission that you’d like to have counted in your total income.

In this case, you’ll need to provide your last pay stub of the previous year (with your bonus or commission amount included) or bring in a letter that explains your commission or bonus structure.

Remember, too, that if you have more than one employer, you’ll need to supply a pay stub from each one.

Proof Of Income Documents For Independent Contractors And Self-Employed Individuals

Most people think W2s when it comes to proving your earnings. But if you’re an independent contractor, have multiple gigs, or are self-employed, you won’t be able to rely on this document.

For independent contractors or active members of the gig economy, what counts as proof of income? Form 1099.

You may also provide proof via digital copies of deposited checks or business invoices. In the latter case, you’ll also need to show the bank statement that documents the deposits that went into your account.

As for self-employed individuals and sole proprietors, you’ll need a copy of last year’s full tax return. This return needs to show your personal income amount.

You’ll also need to show recent proof of income in the form of business invoices (with corresponding bank statements and deposits). Or, you can bring in copies of digital deposited check images.

Moving forward, streamline the process of proving your income by issuing W2s, even if you’re self-employed. Go to Paystubs.net to find out more.

Other Forms Of Income

But what if you receive income from another source? Perhaps as retirement benefits? Rental income, alimony, or child support? Some people also need to prove income from pensions, trusts, or disability benefits.

The documents you’ll need are fairly straightforward. For example, with retirement income and benefits, you’ll need to include a statement of your retirement benefits (and it must be your most recent document).

An annual benefits letter with detailed information about the amount awarded is another way to prove what you’re bringing in.

For alimony and child support, provide a court agreement or order that outlines what you’re entitled to receive. This document should also explain how payments are disbursed and for how long.

For rental income, submit a lease for your rental property. The lease should clearly state the monthly amount, lease terms, and show your name. You should also provide your most recent tax return.

As for income from pensions, trusts, or disability benefits, bring a letter from the administrator detailing the income received, the frequency of payments, and, in the case of disability benefits, their duration.

How To Provide Proof Of Income

How to provide proof of income? It depends on the type of income that you have coming in. But with the tips above, you now know which documentation to obtain.

Ready for more information to help you lead your best life? Browse our blog now for the information that you need to pursue your dreams.