Responsible Investing

Photo from creditpicks

Originally Posted On: https://creditpicks.com/responsible-investing/

While 2020 and 2021 will primarily be known as the years where the world stood still due to the global pandemic, these years will also be known for the rise of a new phenomenon of investors: the retail investor. Perhaps because many people were working from home and receiving government stimulus checks, the rise of the retail investor has given way to ‘meme stocks’, Non-fungible Tokens (NFT), the explosion in the price of cryptocurrencies, and more.

Despite retail investors’ growing presence and participation, it has also shed light on their recklessness and lack of investment knowledge. We aim to explore the behaviour of this new class of investors and why you should not follow in their footsteps if you’re considering investing in the market.

Investing Responsibly

Perhaps, the biggest thing that many new investors either aren’t aware of when they begin their investing journey or are just too easily swayed by “FOMO” (Fear of Missing Out) is investing responsibly. A common attitude amongst these new investors is that they see a stock or crypto shooting up in price by the minute and think they are missing out on this opportunity to make some easy money.

What might happen is that these new investors will immediately invest more money that they can’t afford to invest, or they might even borrow money to fund it. Neither of these options is desirable because, in a nutshell, it’s irresponsible investing.

If you’re thinking about investing, it’s essential always to invest responsibly. But what exactly does this mean? Here are a few tips for investing responsibly.

- First, you should only look to invest what you can afford. It’s important to remember that you shouldn’t be reallocating essential funds into investments if you don’t have to. Suppose you have been consistently allocating a budget of $3,000 every month to live comfortably, including money for your rent, groceries, and bills. In that case, you shouldn’t be dipping into your expense funds to fund your investments.

- Second, if you are looking to invest, you must keep a long-term perspective in mind. While it can be easy to get caught up in the hoopla and excitement of rapid rises in stock and cryptocurrency prices, you also need to know that these prices will just as easily fall as well. If you can understand stock and cryptocurrency prices as a roller coaster that goes through numerous ups and downs in a single ride, then you’ll have a better understanding of your long-term investing strategies.

- Third, this can be an extension of the first point, but you should always try and avoid putting yourself in debt to invest, unless it’s for something that holds its value very well, such as real estate. Sometimes, it can be desirable for investors to borrow money to invest, like when interest rates are very low. However, it’s never a good idea to put yourself into debt to invest in the market, particularly if you’re planning long-term. This is because you may not have any idea how long it will take for your investments to appreciate, and while you wait, you might accrue interest that will also have to be paid along with the principal. In summary, avoid using leverage at all costs to purchase stocks or cryptocurrencies.

How Much Should I Invest?

The honest answer to how much you should invest in capital and crypto markets is subjective and can vary between two people. What may work for someone who makes $100,000 a year and lives in a city with a low cost of living may be decidedly different from another person who makes $70,000 but lives in a city with a very high cost of living.

A good rule of thumb for people that are serious about investing in the markets for the long-term is to consider dedicating anywhere between 10-15% of their annual salary. No one would fault you if you went outside this range, either below or above it, as everyone’s situation is different. Remember that this is just a rule of thumb and not something to which you must adhere. If you can only allocate 5% of your annual salary because you need the money for other areas in your life, this is fine as well!

In terms of when you should invest, once again, this is dependent on your situation. For some people, they may choose to invest a lump sum amount every year. They may do this because investing once a year may be all the time they have or want to dedicate to investing. Others who wish to take a more proactive approach to manage their investments may choose to fund their investments more frequently. However, this amount will likely be much less than a lump sum. Whatever the amount you decide to invest in the market, be sure it’s an amount you can afford to invest and works with how you want to manage your investments.

When Should I Invest?

Okay, so you’ve decided you want to be a responsible investor. But when should you start investing? The answer to this will often be ubiquitous, and that is as early as you can. The sooner you start investing, the better off you’ll be when it comes time to retire.

Why?

Well, there are a few reasons.

The Benefit of Time

The sooner you start investing (let’s say in your 20’s), the more time you’ll have to recover if you invest in riskier investments. It’s not uncommon for younger investors to take on more risky investments in the hopes of striking it rich. However, this strategy is doomed to fail in the long run and can take a toll on your finances. Managing risk is a significant consideration for managing your portfolio, and while you can incur more risk while you’re younger, this should be offset by much safer investments. It should also be a cautionary tale for older investors. Because they theoretically have less time left in their lives, there’s less room for error when it comes to placing bets on risky investments, as it will simply take too much time to recoup the losses. Thus, start investing early and find a sweet spot when investing in risky and safe investments.

Compounding Returns

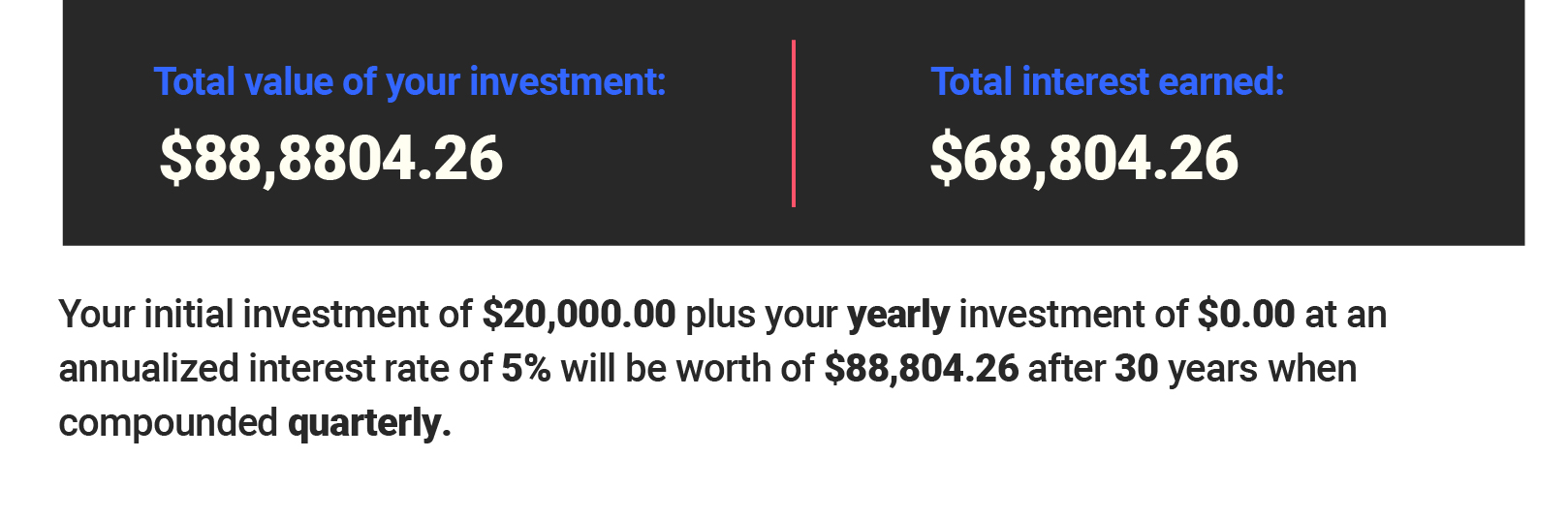

Another reason you’ll want to invest as early as possible is to allow your investments to compound over time. One of the most revelatory things about investing is the prospect of increasing your investment by reinvesting the earnings directly back into your investments. One way to accomplish this is through reinvesting the dividends you would receive from a dividend stock directly back into this same stock. For example, let’s say a $20 stock earns you a 5% dividend every quarter. If you start by investing $20,000 into this $20 stock, you will have 1,000 shares. Now, if you were to take the dividends you received from this stock and reinvest it back into this same stock, after 30 years, your $20,000 principal investment would be worth $88,804.26! Not bad, right?

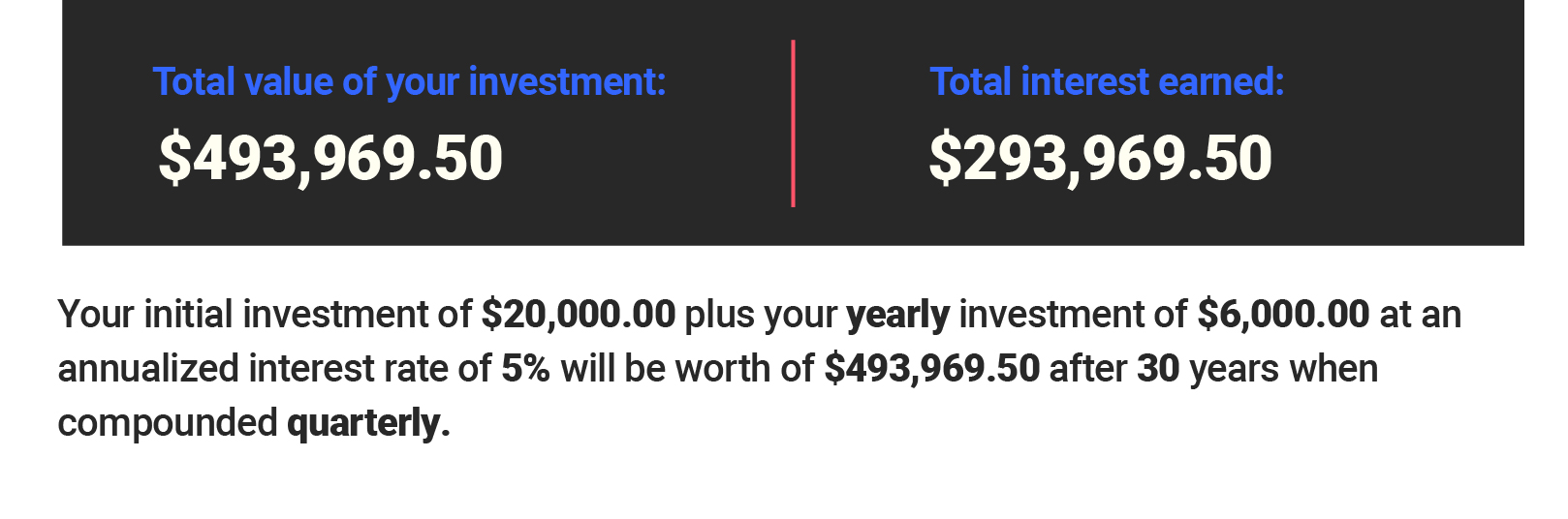

But what if we wanted to increase our stake in this stock by adding a fixed amount of money to it every year? Let’s also say we had the capital to invest an extra $6,000 every year for 30 years. How much would our investment then be worth after 30 years? If everything else stayed the same, at the end of 30 years, our $20,000 investment would be worth a whopping $493,969.50! By contributing an extra $6,000 every year to this same stock, we would be able to increase our investment by an additional $405,165.24.

What this illustrates is that it’s important to, in a way, let your money do the work for you. If you’re in a position to invest in something that will pay you returns without affecting your principal amount, either by having to withdraw from it or selling it altogether, then reinvesting those funds back into the principal will only help grow your investment over time. However, the kicker here lies in the second part of this strategy, which is to make regular contributions to this investment, whether yearly, monthly, etc. These regular contributions will only help grow your money even more, which will come in handy during your retirement years!

Tax-Free Accounts

The adage says there are only two guarantees in life: death and taxes. You should constantly be evaluating all the different ways to minimize the amount of taxes you should pay, legally, of course. Fortunately, for many investors, there are a few different kinds of tax-free savings accounts you can take advantage of to grow your investments while not paying any taxes or withholding paying those taxes until a later point in your life.

We absolutely cannot stress this enough: take full advantage of these tax-free savings accounts. While the savings may seem insignificant to you today or this year, it can be a life-changing amount of money for some people when you add up the savings over your lifetime. Here are some of those tax-free accounts that can grow your investments.

Tax-Free Savings Account (TFSA)

In Canada, every adult can invest in markets using a Tax-Free Savings Account (TFSA). Each year, the Canadian government sets a specific amount you can contribute to this account, and in 2021, that amount is $6,000. The benefit of contributing to a TFSA and holding investments in this account is exempt from capital gains taxes. Thus, if you were to sell a stock that has doubled in price, you would not have to pay capital gains taxes on the gains you made from that sale of stock in your TFSA. The best part of the TFSA is that you can withdraw funds at any time, and you will not have to pay taxes on any withdrawals. If you consistently contribute to your TFSA every year, you can build yourself a very nice nest egg and not one penny of it will be paid in taxes.

Registered Retirement Savings Plan (RRSP)

Another favourable investment account for Canadians is the Registered Retirement Savings Plan (RRSP). The RRSP is slightly different from the TFSA in that at some point, when you do withdraw your funds, you will have to pay taxes, but you’re only able to withdraw funds from your RRSP when you retire. However, the taxes you incur on your withdrawals will not be as high because you won’t be earning income (since you’ll be retired), and thus, the taxes you owe will be much less. The contribution limits for RRSP are also different from the TFSA in that you’re able to contribute up to 18% of your reported income on your tax returns, but with a contribution cap set at $27,830.

Roth IRA

If you live in the United States, the Roth IRA (Individual Retirement Account) is comparable to a TFSA in Canada. It’s slightly different in that you will get taxed on all the money you deposit into this account; however, those funds will be tax-free once you choose to withdraw. This is beneficial because you now pay lower taxes on the funds you deposit into your Roth IRA. Then in retirement, after your investments have greatly appreciated, you would not have to pay any taxes on withdrawing those funds. Like the TFSA, there is an annual contribution limit, and in 2021, it was $6,000.

Final Words

Investing responsibly can seem very dull. It’s incredibly easy to switch on the TV and watch the price of stocks and cryptos soar, and it may feel like it’s happening daily. You could be missing out on a fantastic opportunity to invest in these speculative investments because you want to get in on the action. However, many people don’t understand that these riskier investments tend to have much more volatile price movements and may not fit the bill for a safe investment for retirement.

That’s why the boring play here can be a good thing, and by investing responsibly, you can think of it as delayed gratification. While it may be hard to see and reap the benefits of your investments now or in the near future, you will come out as the big winner in the long run. Exercising patience and the will not get swept up in the hype of speculative investments will also pay massive dividends when it comes time for you to retire.