Making Money on Property

Photo by Celyn Kang

Originally Posted On: https://blog.heatongroup.co.uk/news/making-money-property

Property investment has long been a huge industry. From the sole trader who renovates single properties for a profit before moving on to the property developers like ourselves who run multiple projects across multiple areas. So how then do you get started and once you’re involved – how does this become profitable?

Humble beginnings

The most common story told by property developers of any size is how they started out. It’s usually one property (often a nightmare!) that taught them more than any guide or blog post ever could. Known as “flipping” the premise is simple, buy low and sell or rent high. However, this isn’t always the case. Sometimes mistakes can be made during this process as the bargain you anticipated turns into a money pit. By the end of the project, you’re just happy to get rid! Investing in property does bring with it the ideal that everyone wants to make money – so to do so you’ll have to budget effectively, build relationships with tradespeople and refine your process at the end so that you’re effectively selling the minute the property is completed rather than holding a property which restricts the ability to move to the next project.

It helps to have a “stamp” too if you’re looking to continue, modernisation is one of the more in-demand solutions required by today’s buyers. There are plenty of other stamps you can have on the property too, such as minimalisation, renovation and complete change. The house buyers in today’s market are more geared towards a “hands-off” approach when it comes to living; they’d much prefer the work to be done before they purchase the property, rather than move into a “fixer-upper”. This does present itself with unique challenges – what you see as beautiful interior design may not resonate with your target market, however, we live today in the world of social media so finding out what’s popular is easier than ever. A quick trip to Pinterest for the term “bathrooms” suggests that people enjoy a more traditional look with exposed vintage taps, old-style sinks and neutral colour schemes.

Invest in areas with growth

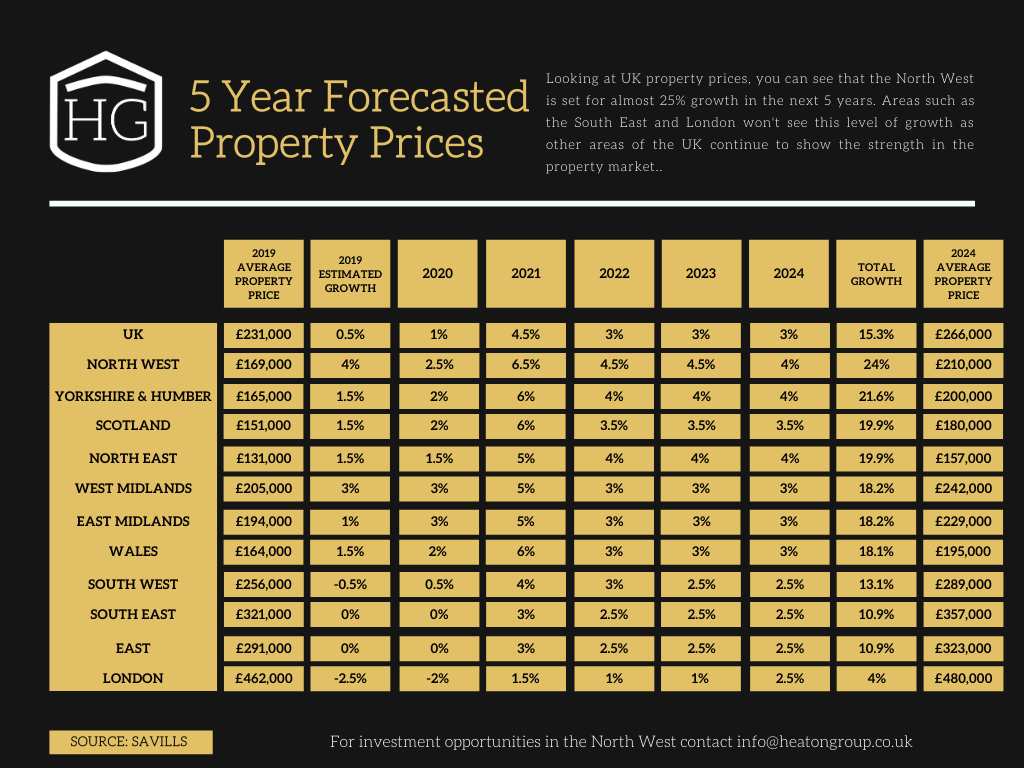

For those who rely on companies like The Heaton Group, there does need to be a massive consideration around what areas are likely to grow, rather than what’s selling for high prices right now. You can sell a 1-bedroom apartment in London for more than £400,000. However, you’re unlikely to make much money from it. It’s likely to have cost almost that to buy it, and the rental yield in London is below the national average, so while you’ve had the property you’ve not made as much money as you could have. At the Heaton Group, we’ve identified the North West as a massive area for significant growth. Property prices are expected to rise by 24% in the next five years. The same timescale sees London’s property prices rise by 4%. During that time too, there will be a high rental yield of well over 6%, compared to around 4% for London.

.png?width=905&name=HG Rental Prices (4).png)

The Northern Powerhouse is playing a part in this, significant government and private investment in these areas are pushing up prices quickly. We’d recommend getting involved sooner rather than later – otherwise, you’re missing out on a huge opportunity.

Hands-off or hands-on?

Our investors or wealth management clients prefer the “hands-off” approach. There are associated costs with investing in a fully managed property. However, it’s by far the easiest way to sit back and make money. If you’re more hands-on, then you’ve got a wealth of considerations to take in such as insurances, energy bills, tenanting, deposits, maintenance – the list goes on. We’ve got an advantage because over the last 40 years we’ve built a business around this. We fully manage all of our investors’ tenants, we bulk buy energy, provide smart solutions to homes and as a business receive favourable rates on insurances as well as provide our own building maintenance teams.

Mortgage or Cash purchase

Every single property developer in the UK prefers cash. It’s just how it is and always will be. As such, they will still provide their very best price to those who pay in cash. With the Heaton Group, there’s up to a 5% discount on the property price when paying with cash. Over time, when it comes to selling the property outright, this can equate to quite the saving. There are mortgages available if you’re starting out and don’t have the capital for the outlay of a cash purchase, but ensuring you have the right one is paramount to how your property investment will proceed.

For example, the average price of our apartments at Bishopgate Gardens is £160,000. If you buy this with cash, you will save yourself £8000. If you then sell the property five years later for (predicted) £200,000, you’ve then made £48,000 in 5 years, not including the average rent per month of £650 x 60 (months) which is £39,000. You’ve then made £87,000 in total. Of course, these are exceptionally simplified and don’t take into account various fees such as:

- Rental fees (Heaton Group charge 6% + VAT)

- Solicitors (varied)

- Management

- Maintenance fees (on new builds/developments this is likely to be very low)

- Ground rent (Heaton Group set this at £250 per year for 100 years)

- Service charges

So, against the above figure, we’d anticipate a profit of roughly £70,000 on a cash purchase at Bishopgate Gardens. Mortgages complicate things due to interest rates and the amount lent/deposits etc. We’re delighted to accept both forms, but the profit is considerably higher when purchasing with cash.

And it really is as simple as that. If you’re investing solo, then ensure you get into the right areas, and you treat each stage as a learning curve. Most people struggle initially – which is why property developers like the Heaton Group handle property investment.

If you’re interested in any of our developments, then please call us on 01942 251945 or email us at [email protected].