Kanban Boards: Continuous Improvement for Financial Services

Photo by airfocus

Originally Posted On: https://www.planstreetinc.com/kanban-boards-continuous-improvement-for-financial-services/

There is always room for improvement

If you think that your organization’s financial services processes are perfect with absolutely zero room for improvement, consider taking another look. There is always room for improvement. In fact, good management should always be identifying opportunities to increase efficiency and effectiveness in processes. Legendary football coach Vince Lombardi once said:

“Perfection is not attainable. But if we chase perfection, we can catch excellence.”

This quote is an absolute gold mine of inspiration, but there are two really great takeaways here. First, perfection is not attainable, and no one should take it to heart when it isn’t achieved. Secondly, and most importantly, is that this quote reveals a formula for excellence: the pursuit of perfection.

For financial service firms and departments seeking to refine their current processes, there is a trusted and long used method that can be applied to an organization’s procedures. It helps to provide the best value for the accountants working on the tasks, the firm that the accountants are working for, and, ultimately, the client that the firm is servicing. It is proven. It is simple. This is the Kanban board method.

So what exactly is the Kanban process?

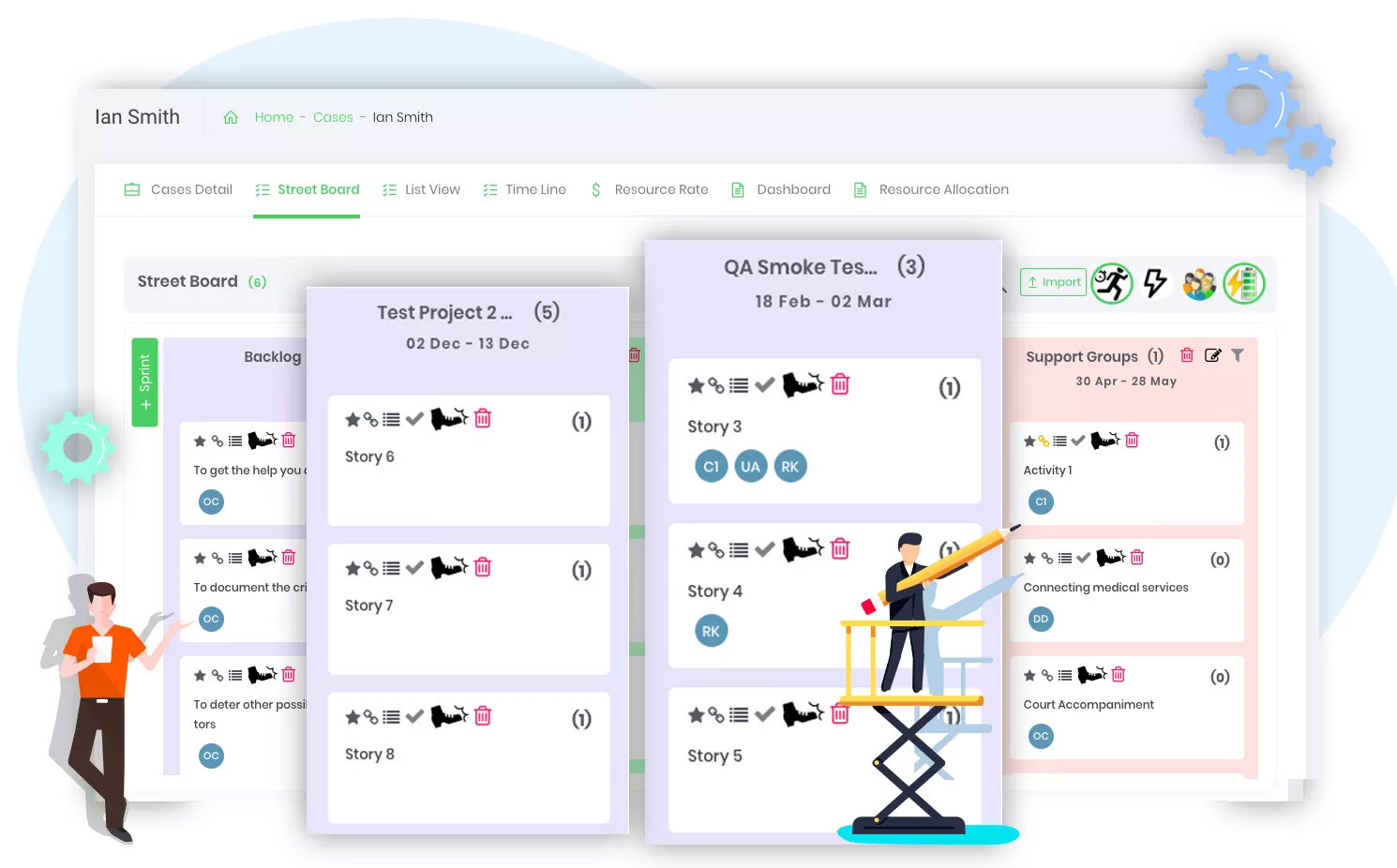

Kanban is a visual method for analyzing what work there is to be done, what is currently being worked on, and what has been completed. The primary goal of this method is to identify bottlenecks so they can be addressed in favor of a more efficient movement toward the end goal. Kanban can be tracked on a board with each of those statuses (to-do, being done, done) occupying a column and various tasks listed in each one depending on where they currently stand.

The three-column system just described is the most simplistic route that can be taken with Kanban boards; however, they are easily scaled and customized to meet the needs of the specific firm or task. For instance, another column can be added before the “to-do” column to track backlogged tasks. Columns can also be sub-divided where needed, or a set of horizontal rows called swim lanes can be added to help organize the workflow.

All of this works toward a singular, focused goal: gradual and continuous improvement.

It always helps to know where things started

Perspective on where things began can often inform why processes are effective. Kanban developed in lean manufacturing in the auto industry and is most commonly associated with Toyota. Early adopters of this method sought to reconcile inventory levels with the actual consumption of goods in hopes of streamlining procedures and eliminating potential waste. In essence, the rate of demand controls the rate of production. The process is widely used in a variety of industries, including manufacturing, financial services, and software development.

Important things to keep in mind

Kanban boards can be as simple or as complicated as they need to be. In their most simplistic form, there might just be the three columns outlining items that are to-dos, those being done, and those completed. A variety of other factors can be integrated into the boards to address any number of specific needs that an organization might require.

One of the most important things to remember is that in contrast with many other project management methods, Kanban is not necessarily intended to be a from-scratch process. Instead, when implementing Kanban boards, it is assumed that there is an existing process in place that the Kanban board is in place to improve. Because the boards are intended to improve existing processes, they can be applied across a variety of disciplines, including financial services.

Key principles that guide the Kanban method

Six guiding principles inform the Kanban board method. All play a significant role and, when used in concert, are almost certain to yield positive results.

- Visualize the flow of work – Whether this is done on a physical whiteboard or a Kanban board software, this is the initial and most important aspect of the method. Seeing the work that is to be done and the process that you currently have in place to achieve this. For accountants with a lot on their plate, this is a valuable first step.

- Limit work in progress – In staging clients and tasks by the completion status, accountants can focus on a single task at hand and see it through to completion without the pressure of several ongoing simultaneous tasks. Keeping a clear separation between tasks helps to ensure each one is completed with a high level of thoroughness.

- Manage flow – This stage of the method is where identifying bottlenecks is crucial. At this stage, the workflow of the various tasks is analyzed, and team managers can see potential roadblocks that will slow down the project’s pulling into the next stage. Once a roadblock is removed, it will likely be most easily identified in other processes and will allow for continuous improvement and focus on other roadblocks moving forward.

- Make process policies explicit – This aspect of the method is where teams start to agree on guidelines for how tasks and processes will be conducted. For instance, the definition of when a task is complete is agreed on. This ensures that everyone working in the team knows what completion looks like without any ambiguity. A clear definition of terms and expectations creates a common understanding of which projects can be conducted.

- Implement feedback loops – Reflection and analysis are hallmarks of any good project management process. As tasks move through the various stages of completion on the Kanban board, the stages need to be reviewed and vigorously measured with metrics.

- Improve collaboratively, evolve experimentally – The name of the game with Kanban is gradual and consistent improvement. If the previous five principles are followed through effectively, this one should come easy. The finance team can find areas of their processes that need improvement and can visually test possible solutions.

The Kanban board method is well suited to help improve the financial service industry

Kanban boards can be adapted to fit almost any industry, and there are several ways they are ideal for accounting and finance firms. There is certainly no shortage of methods and project management resources available to the financial industry to improve and organize, and they all have their advantages and disadvantages. While most are likely effective in their way, they can also be cumbersome, expensive, rigid, and difficult to implement and communicate to the team.

- They are scalable: Due to Kanban boards’ scalable nature, they can be utilized in large firms with hundreds of accountants servicing hundreds of clients at the organizational level or zoomed in on the specific accountant or client level focusing just on one set of tasks. This allows for management to identify bottlenecks and inefficiencies at both macro and micro levels. Boards can even be scaled for specific projects within a firm. For instance, if a small team of accountants has a relatively simple project that requires basic organization, a simple board of three columns setting the to-do, in process, and completion may be all that is required. However, if there is a large team consisting of many accountants working on a large scale project for the same client, a more involved and information-heavy board may be required.

- Prioritizing the never-ending list of tasks: Kanban boards also serve as a staging ground for prioritizing upcoming tasks. As tasks are moved along the board toward completion, a new task can be selected for any specific team member based on his or her suitability for the task. Given the variety of tasks in the financial services industry, not every accountant on staff may be the best equipped for every task. Kanban boards allow for tasks to be staged and put into motion when the best-suited candidate for the job is available.

- The right people in the right place: An efficient allocation of resources is critical in managing any organization, and this is no different in the financial services industry. It is an industry that isn’t immune to the whims of the marketplace as well as the ever-important goal of running a department as lean as possible. This can often result in small teams of accountants working on a wide variety of tasks at any given time. When a small team is taking on a wide array of projects, the available resources must be used in the most effective manner possible. Kanban boards are ideal for this very purpose.

- Tracking how resources are used for specific clients: A challenge that most financial service organizations or departments face is knowing how much to bill a client based on the time and resources spent on their specific projects. This can lead to significant under-billing or over-billing, with both being a detriment to either party involved. Utilizing Kanban boards forces the organization to take a very analytical look at processes that will result in a more accurate picture of how resources are dedicated to specific client projects. Keeping careful track of those resources and communicating those to the client leads perfectly into our next reason: transparency.

- Transparency is critical to finance: Perhaps in no other industry is a transparent process more critical than in financial services. Every action is logged, and every project is subject to scrutiny. Clients expect transparency in their accounting, and financial firms stake their reputations on it. Utilizing a Kanban board to organize workflow keeps everyone on the same page and results in multiple sets of eyes on all aspects of the task. Kanban boards can serve as an excellent tool for accountability themselves as well as improving those transparency initiatives, the more they are utilized.

Kanban board pursue perfection, but they aren’t perfect themselves

Kanban boards are simple to implement and excel in focusing a team on specific tasks; however, they are not without some disadvantages. Two issues can arise when using Kanban boards for department improvement.

First, the boards can become much less effective when they are made overly complicated. The beauty of this method lies in its simplicity, and with too much tinkering, it can erode quickly. The board needs to be lean, simple, and easy to read. Tasks, status, and ownership should be easily understood in a quick glance.

Secondly, Kanban boards do not convey specific times for the completion of the states. So while it is exceptional with tracking where tasks are on a spectrum (to-do, in process, complete, etc…), it is not equipped to show deadlines or project completion date. If there is any attempt to try to shoehorn that type of information on to the board, the accounting team can run the risk of running afoul of the first problem by overcomplicating a necessarily simple method.

In the end, these are two relatively minor issues with the method. They are representative more of the fact that the boards aren’t designed to foster those specific attributes and instead focus on other efficiencies. The advantages far outweigh the challenges that may arise with the Kanban board.

Consider Kanban as a way to keep getting better!

Visual. Easy to understand. Focused. Simple. It would be difficult to ask for more from a project management method. Kanban excels in organizing tasks and keeping the team focused, but it also serves a purpose on a much larger scale. Kanban boards are designed to foster continuous improvement. What a powerful guide stone for a financial services team! Slow and gradual improvement that doesn’t disrupt the existing workflow but instead seeks to remove bottlenecks and impediments slowly. This mentality creates a culture around the team, and if everyone on the financial services team is bought into this culture, significant improvements could be seen after a while.

The financial services industry is one that is nuanced, heavily regulated, and constantly changing. For these reasons, continuous improvement, organization, and prioritization are critical for ensuring that a team is always looking for a better way to do things. If you feel like your team is stagnant, consider implementing Kanban boards. Over time, you might find your processes greatly improved.