Insight Report: How Single Family Offices Invest In The Energy Revolution

Photo From familyofficehub.io

Originally Posted On: https://familyofficehub.io/blog/insight-report-how-single-family-offices-invest-in-the-energy-revolution/

Diminishing resources and climate change urge the world to transition from coal and oil to a world with greener energy from renewables. The energy transition creates space for innovation and opportunities for young as well as established companies. There are various topics and challenges that require innovative solutions: from smart grids to renewable power generation and energy storage. For all this research and product development heavy investments are required. Besides usual investors like private equity and venture capital funds, single family offices (HNWI investment firms) are massively investing in silence. However, family offices are often overlooked when analysing the energy market. We illustrate the various ways how single family offices invest in renewables and the energy transition.

Types of different investments in the energy revolution

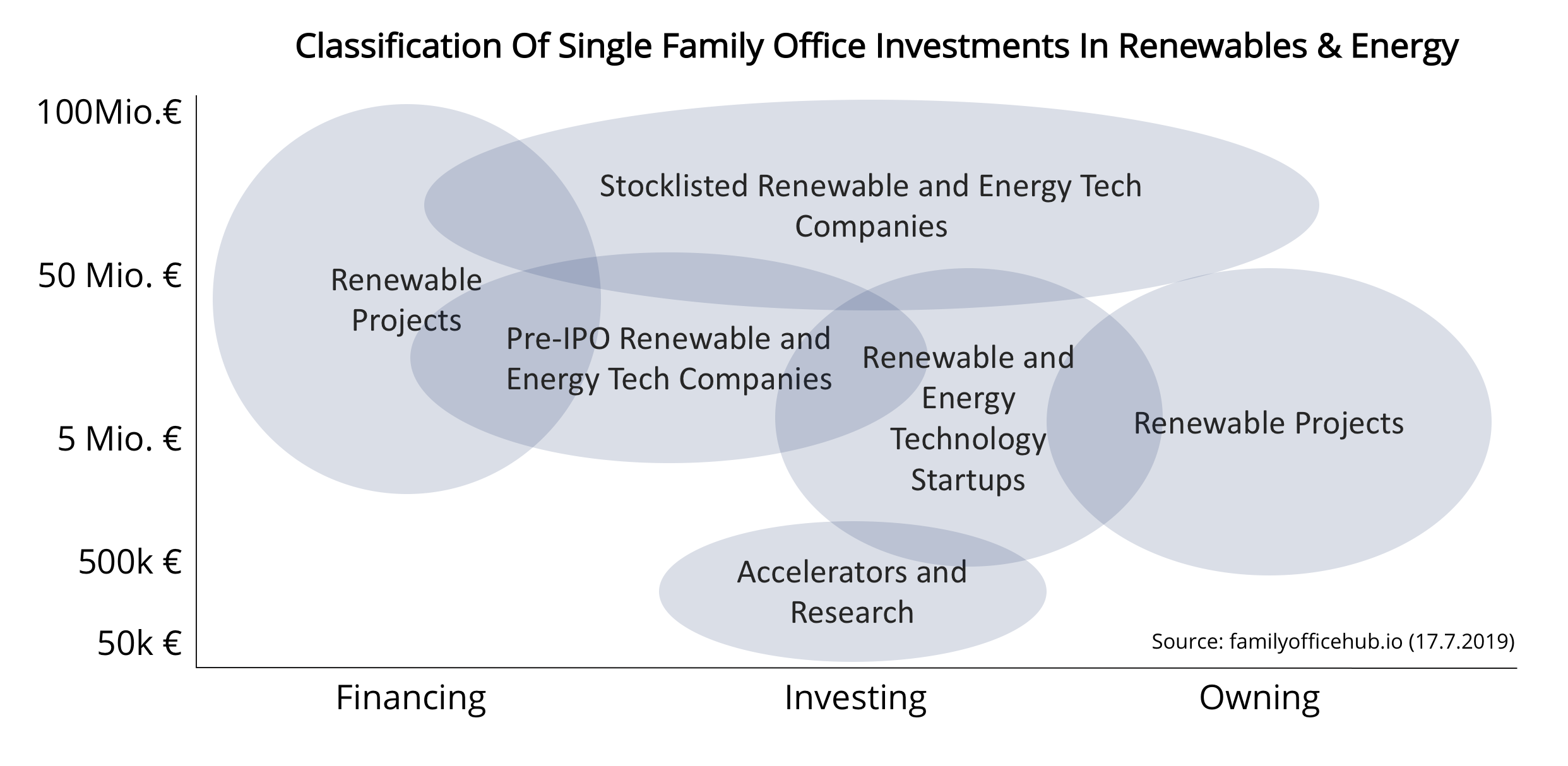

This report aims to illustrate the different ways of how family offices are able to invest in the energy revolution:

1) Financing: Providing loans to mature startups, companies or asset managers to grow or to build up new renewable installations (wind parks, solar farms)

2) Investing: Acquiring shares of startups or established companies to support their growth and research. Also investing in public and semi-public projects or accelerator programs.

3) Owning: Actively managing own renewable plants or even renewable companies.

In the following, we investigate how exactly family offices are engaged in the specific types of investments.

1) Financing of Renewable Companies and Projects

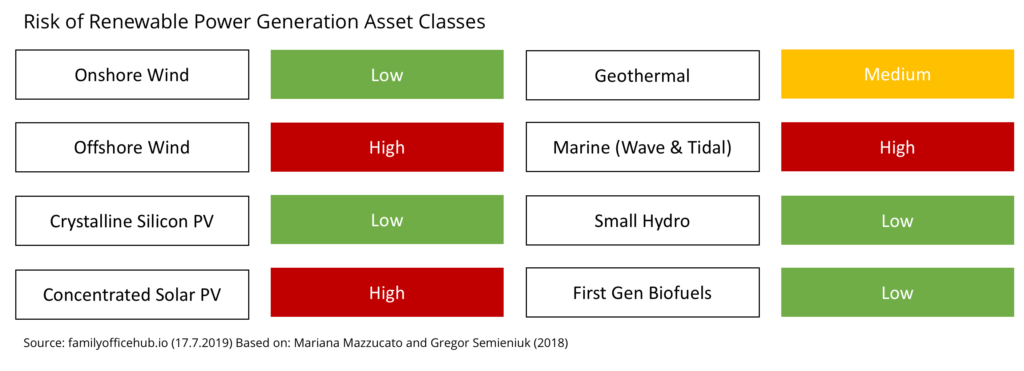

Renewable power generation projects come in different shapes and forms like wind, geothermal, hydro, solar or biomass. Family offices often provide the necessary capital for the projects, thereby earning decent returns with limited risk. In a study of Taylor Wessing, a third of the surveyed family offices stated that they want to increase their investments in renewable construction or operational stage projects. The project financing process is in most cases straightforward: financing family offices provide a loan, energy companies or project developers build the plant (e.g. a wind park), after the realization the project delivers cash flows which are used to pay back the financing firm (including interest). Risk differs between the types of power generation assets, according to research of Mariana Mazzucato and Gregor Semieniuk (2018):

Interestingly, the risk profiles of certain asset classes change over time: while before 2004 solar PV was affiliated with high risks, today these projects are rather low risk investments. Also first generation biofuels have lower risk than newer second generation biofuels. Family offices have to decide at this point which risk they are accepting. As usual in the investment world, higher risks are also coming along with higher possible returns. Besides the asset class, the maturity, the country and the experience of the project developer determine the risk profile. A novel company with a solar project in Africa which is in planning phase is way riskier than a pre-construction wind farm in Norway which is led by an experienced energy company with already billions of dollars in sales.

Low risk projects are meanwhile often financed by pension funds and insurances. Family offices are especially relevant for projects with medium or high risk. Since banks are shying away from the risk there is a massive lack of funding. Family offices who build up in-house know-how fill this gap. Also later-stage startups or growing companies are backed through family office loans. In most cases the family offices are staying in the background.

Exemplary Family Offices Deals for Renewables Project Financing:

- Guzman Energy Group received a $130 million investment in mezzanine debt (and also equity) from the Walton Family Office Zoma Capital. Guzman works on price stability solutions for renewables for rural electric coops.

- A family office joined a $20 million debt financing round for ZOLA Electric, which is Africa’s leading reneweable energy brand.

2) Investing in renewable startups and established energy companies

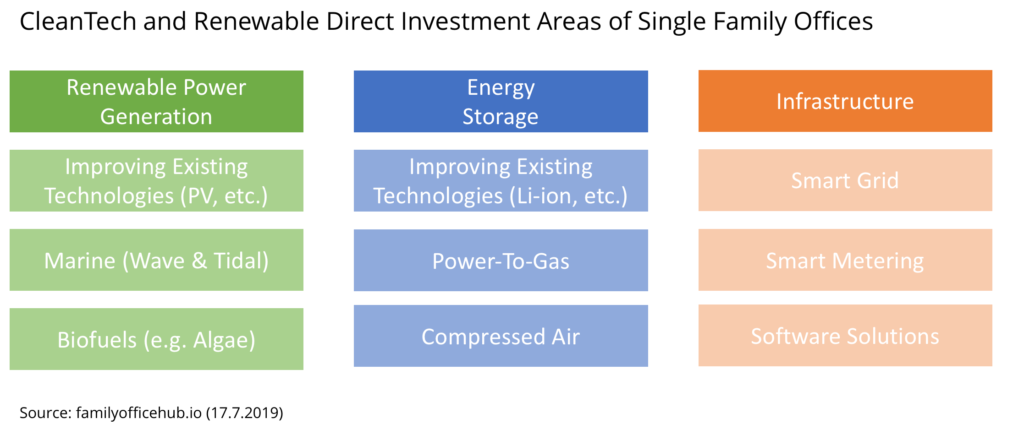

Many family offices are directly investing in so-called cleantech startups which (among other things) work on new technologies in the energy and renewables sector. Specific areas of the funded companies wary widely: from new carbon-dioxide free power generation technologies to energy storage solutions. We summarized various areas:

We can divide possible renewable investment sectors into three big topics: power generation technologies, storage solutions and infrastructure. Generation technologies use novel resources or technologies, storage solutions are necessary to compensate the high volatility of renewables, smart grid solutions can save energy and are necessary to implement new technologies (e.g. certain software solutions are required to integrate households who produce energy on their own into the grid). While some startups are improving already existing technologies, some others are inventing completely new solutions.

The stages of family office investments in cleantech companies are different. Some SFOs engage in seed financing and are also backing accelerators and research programs, while others are focused on later-stage (or even Pre-IPO) financing. Other family offices are directly investing in already stocklisted renewable or technology companies. For example, the Lego Single Family Office is a major owner of Landis + Gyr, the Swiss market leader for smart metering solutions. Some family offices are simply contributing money to renewable funds instead of picking particular investments.

Exemplary Family Offices Deals for Direct Investments in Renewable and CleanTech Startups :

- Swiss smart grid startup DEPsys received a new €13.2M funding round, amongst others by the Wecken & Cie, a Swiss single family office.

- Swiss Caliza family office joined a funding round for Munich-based Power-To-Methane company Electrochaea

- Off-grid solar solutions company SolarHome received $1.2 million investment from Beenext, a Singapore-based impact-investing family office.

3) Family offices actively owning and managing renewable energy assets

Family offices have to decide if they only want to finance renewable projects, invest in dedicated companies – or if they want to manage renewable power generation plants on their own. Especially for larger single family offices this can make sense: fees can be avoided, economies of scale realized – and maybe services can be even offered to external investors. An increasing number of family offices decides to run renewable assets on their own. Some even build stocklisted, valuable companies from this business. The process mostly starts with hiring an experienced manager from the energy sector. Thereafter, first projects are developed or already existing projects are bought. Especially for windparks and solar farms the risk is limited and returns are at least in the medium range.

Exemplary Family Offices who own and manage renewable projects:

- German single family office Wirtgen Invest owns PV installations in Czech Republic and wind parks in Sweden and Poland.

- Encavis, a German renewables asset manager, was initiated and from early on financed from family offices. Today, the Bühl, Liedtke and Kreke family offices are major shareholders of the stocklisted company.

- Treehouse Management is a single family office whose wealth arised from real estate in Puerto Rico. Today, the family office is “developing, owning and operating mid-scale renewable energy projects in North America”.

Conclusion: Family Offices as Essential Investors in Renewables

We illustrated how single family offices in Europe and North America are investing in the transition to a world with more renewables. By investments in renewables and associated technologies, make a contribution to a more sustainable world and receive decent returns. Possible investment vehicles and investment types are different. Most family offices are directly investing in renewable companies and startups or financing projects.

Sources:

BizJournals (17.07.2019)

TaylorWessing (17.07.2019)

PV Magazine (17.07.2019)

Renewablesnow (17.07.2019)

Mazzucato, Semieniuk (2018) (17.07.2019)